There’s a quiet but constant tension humming in the background of every nonprofit’s work—a legal wire to balance on, with rules that evolve as quickly as the causes do. Whether you’re running a local youth mentorship nonprofit or coordinating refugee aid across three continents, legal and regulatory compliance is not a side task. It’s the foundation that protects your work, your people, and your funding.

In this post, we’ll explore how nonprofits—particularly international NGOs (INGOs)—can establish strong legal footing, meet complex compliance demands, and protect themselves while doing good.

Why Legal Structure and Governance Matter

The choice of your legal structure isn’t just paperwork. It determines:

- Tax benefits

- Eligibility for grants

- Governance requirements

- Liability protection

- Public trust

A registered nonprofit—whether it’s a 501(c)(3) in the U.S., a CIC in the U.K., or an Association Loi 1901 in France—signals legitimacy to donors and governments. But it also commits you to a lifetime of reporting, ethical board oversight, and operational transparency.

Starting and Registering an NGO: Basics and Best Practices

Before launching programs, many organizations forget to ask: Should we start something new, or partner with an existing entity?

According to the National Council of Nonprofits, over 1.5 million nonprofits are registered in the U.S. alone—yet many close within 3–5 years due to poor planning or legal missteps.

Key legal steps include:

- Choosing a structure (trust, association, company limited by guarantee, etc.)

- Registering with a national body (e.g., IRS in the U.S., Charity Commission in the U.K.)

- Drafting bylaws and a board governance plan

- Filing for tax-exempt status

- Complying with local labor and anti-discrimination laws

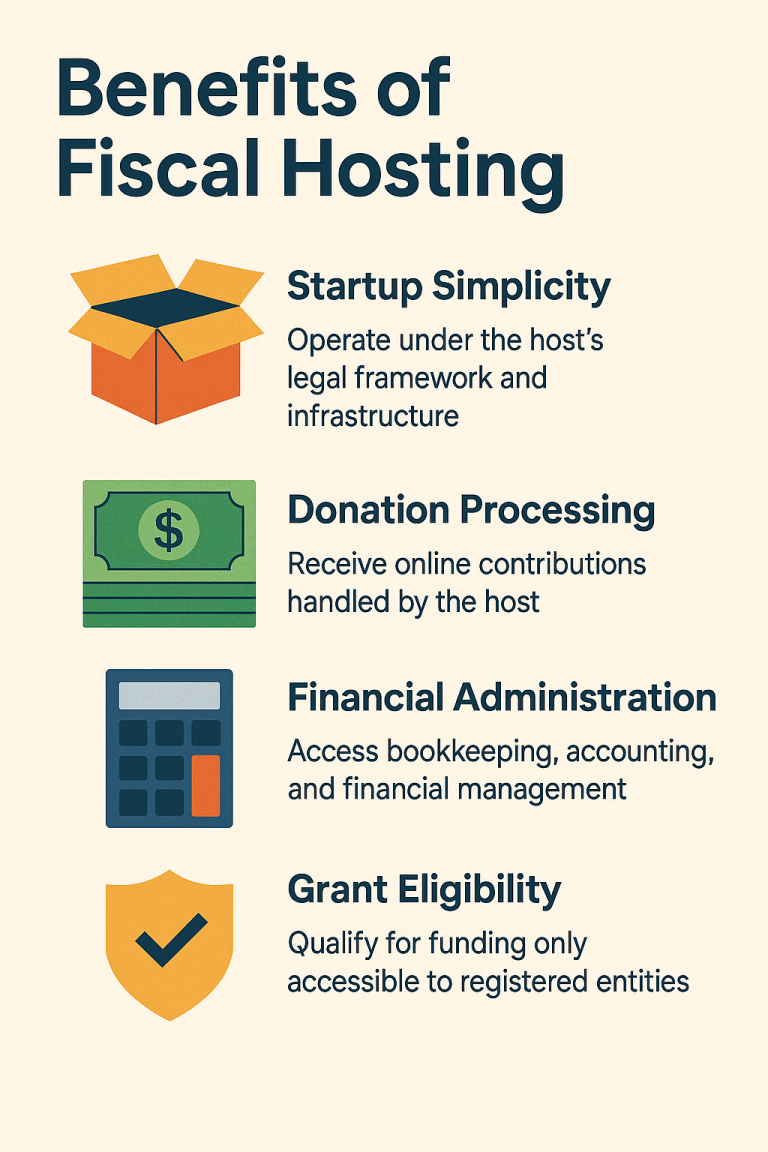

🌍 International Tip: Many NGOs begin under a fiscal sponsor, such as VCS Academy, to test their model and receive tax-deductible donations before incorporating.

Board Governance and Fiduciary Duty: More Than Just Meetings

Board members aren’t advisors—they’re legal stewards. They are responsible for three core duties:

- Duty of Care – Actively participate and make informed decisions.

- Duty of Loyalty – Avoid conflicts of interest.

- Duty of Obedience – Stay true to the organization’s mission and comply with the law.

Boards should meet regularly, keep minutes, approve budgets, and review the executive director’s performance. According to BoardSource’s Leading with Intent 2023, only 43% of boards assess their own effectiveness—a missed opportunity for risk prevention and impact.

🛠 Tools: NAWA’s Boards in Gear guide and 501 Commons’ board matrix tools offer templates for strengthening governance.

Cross-Border Giving and International Law

As soon as your funding crosses a border, a new layer of scrutiny emerges. INGOs must navigate:

- OFAC sanctions (U.S. Treasury)

- FATF anti-money laundering standards

- EU AML Directives

- Know Your Customer (KYC) rules for donors and vendors

- Exchange control laws in countries like Ethiopia, Egypt, and Zimbabwe

Failure to comply can freeze bank accounts or lead to donor blacklisting.

According to the FATF 2023 Typologies Report, over 60 countries have tightened laws on cross-border financial flows since 2020—many directly impacting NGOs.

🔐 Real-World Case: A top project (under VCS Academy) was terminated due to policy breaches, including failure to vet donors and unauthorized personal fund transfers—illustrating how small oversights can trigger major consequences.

Reporting Requirements: IRS, AML/CFT, and Beyond

NGOs must comply with both financial and programmatic reporting rules, which vary by country and funder.

In the U.S.:

- Form 990: Filed annually with the IRS, detailing governance, compensation, and financial data

- FinCEN reports: Required for financial institutions, but NGOs may fall under scrutiny if engaged in cross-border giving

- Donor Receipts: Must include clear tax language

Globally:

- Foreign Contribution Act (FCRA) in India

- General Data Protection Regulation (GDPR) in the EU

- Charity Transparency Framework in Singapore

💡 TIP: Keep a compliance calendar—tools like Monday.com or Airtable can auto-track deadlines across jurisdictions.

Risks of Non-Compliance

Legal missteps can result in:

- Fines (up to $20M under OFAC violations)

- Deregistration or revoked charity status

- Loss of donor trust

- Reputational harm that affects mission delivery

Transparency International reports that lack of financial and legal transparency is a top-3 reason funders pull support from NGOs.

How to Stay Ahead

- Train your staff on AML, data protection, and fiduciary duties.

- Invest in legal counsel, either internal or through networks like TrustLaw.

- Use tech tools for compliance tracking.

- Monitor legislation with alerts from ICNL or FATF.

- Audit annually—internally or through a third party.

🧠 Learning Resource: The Nonprofit Association of Washington’s Let’s Go Legal toolkit is a step-by-step guide to building legal resilience.

Final Thoughts

Staying legally sound as an NGO isn’t about avoiding fines—it’s about proving to the world that your mission is rooted in trust. Good intentions need strong infrastructure. And a legally healthy NGO is one that can be bold, brave, and credible in every community it touches.

Because when you’re on solid ground, you can reach higher.

📚 References

- International Center for Not-for-Profit Law (ICNL). (2023). Global Legal Trends for NGOs

- FATF. (2023). NGO Risk-Based Approach Guidance

- BoardSource. (2023). Leading with Intent: BoardSource Index of Nonprofit Board Practices

- NAWA. (2023). Boards in Gear Guidebook

- U.S. Department of the Treasury. (2023). OFAC Regulations for Nonprofits

- USAID. (2023). Compliance Toolkit for International Partners

- VCS Academy Legal Department Response (2025). Internal Termination Memo for a VCS Project