Process and steps

The simplest risk management process that’s applicable to most organisational sizes:

- Risk Identification

- Risk Assessment

- Risk Management (Avoid, Mitigate, or Accept)

Step 1: Identify Risks

at board level: Board members must understand the following:

The organisation’s mission, values, and context:

- Who is our community?

- How have we promised to serve them?

- How do we do our work?

To develop the detail, questions to answer:

- The context, especially in relation to other players: what are funder expectations? What is the organisation’s capacity to meet those expectations? Who are our partners? Our champions? What are they doing?

- The challenges being faced at the operations level and, sometimes, at the programming and service delivery level.

- Good practices around audits (financial and otherwise).

- How other organisations function and adapt to their contexts, the risks and consequences they have faced; comparison can be useful tool to identify and assess risks.

at staff team level: Conduct risk assessment and make note of anything that appears unsafe or could pose a threat to clients, volunteers, staff.

- Are there processes in place if there is an incident? (fire exits, first aid kits, …)

- Are staff and volunteers properly trained on internal procedures related to safety incidents? (incident reports, reporting structures, …)

To develop the detail, actions to perform:

- Keep good records of what happens at the organisation and share them with the board

- Maintain an up to date risk register and record response strategy specific to risks.

- What are some of the challenges that staff and volunteers face?

- With the space?

- With meeting funding requirements

- and deadlines?

Step 2: Assess Risks

Assessment vs. Management: It’s impossible to avoid risk so instead we have to develop methods to assess and manage risk: make sure that we take all necessary steps to increase our chances of having positive (not negative) outcomes.

To manage risks: There are three key elements to managing risk:

- Avoid/transfer it

- Mitigate/lessen it

- Accept it

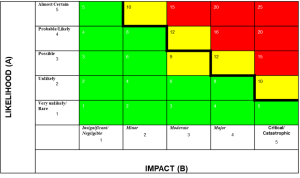

How risks are measured (RAG) rated: Likelihood vs. Impact, or could it happen, and would it hurt

Step 3: Manage Risks

Avoid/Transfer Risk: Create Risk Minimisation Policies:

- Addresses your policies and procedures to avoid such risk. Consideration for termination of services, projects, and/or activities that have a high likelihood and high impact on the organisation’s objectives.

- Reject engagement in high risk projects/services.

Insurance and Risk: the concept of liability Insurance related to the transference of risk; i.e. you share the risk with an insurance company. Libaility insurance:

- Protects your organization, board and staff

- Purchase charity insurance coverage from most insurance companies

- Get quotes from a number of different companies

Mitigate Risks: Create Risk Tolerance Policies:

- Addresses your appetite for risk (willingness) vs. your capacity for risk (ability to handle.

- Develop and test processes for assessing risk in your work: what do they look like? Who’s involved? How long do they take? What if it’s a crisis?

Tolerance for risk is dependent upon:

- Finances: do you have reserves? How much money do you usually bring in? Spend? How much can you lose/forego and still operate?

- Donor support, reputation, credibility

- Experience and competence of staff and volunteers

- Limits of Chief Executive Officers and/or Executive Director authority, information board should receive before making decisions

- Consider potential risk vs. Opportunity: what’s the worst thing that could happen and the best thing that could happen? How likely are each of these scenarios?

- Consider alternatives!